Festive Car Sales October 2025 Know which company sold how many units

Festive Car Sales October 2025 Know which company sold how many units.

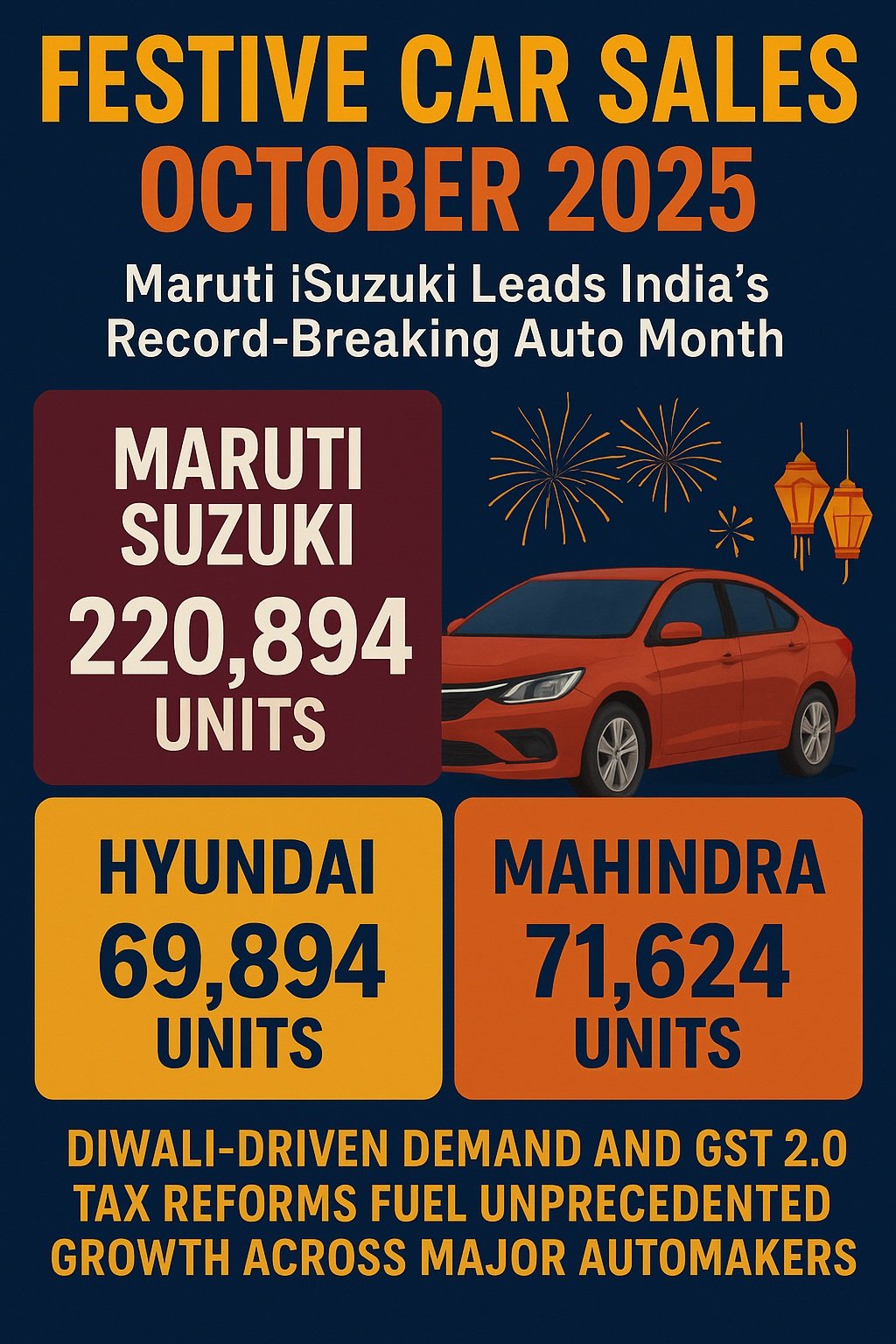

Festive Car Sales October 2025 : October 2025 has proved to be a blockbuster month for the Indian automotive industry, thanks to the confluence of strong festive demand (Diwali, Dussehra/Dhanteras) and favourable tax reforms (including the so-called “GST 2.0” rationalisation). Leading manufacturers posted record volumes, reshuffling competitive positions and signalling a robust start to the festive sales cycle for FY26.

Here’s a detailed breakdown of how the major players performed, what drove the surge, and what it could mean for the rest of the year.

1. Stand-out Leader: Maruti Suzuki India Ltd

Maruti Suzuki dominated the boardroom in October 2025. The company reported total sales of 220,894 units, its highest-ever monthly tally.

Of those:

Domestic volume reached 180,675 units.

Exports amounted to 31,304 units.

Sales to other OEMs (component or kit supply) were 8,915 units.

Why did Maruti deliver such a strong performance?

The festive period spurred buyers on, and Maruti’s wide model portfolio (compact cars + SUVs/MPVs) meant it had offerings across budgets.

The compact-car line (e.g., models like the Swift, Baleno, Wagon R, etc) delivered substantial numbers—Maruti reported 76,143 units in the compact car segment in October.

SUV/MPV demand continues to rise. Maruti reported 77,571 units for its utility vehicles in Oct.

The tax changes under GST 2.0 reduced list prices for several models, improving affordability during the festival shopping window.

Maruti’s dominance this month underscores its market-leadership position, and importantly sets a benchmark for competition.

2. Strong Growth: Tata Motors Passenger Vehicles

Tata Motors’ passenger-vehicle business also had a standout month. According to Vahan portal data, Tata achieved 74,705 units in retail passenger vehicle sales (domestic) in October 2025.

That placed Tata above some rivals in the October race, with growth of 81.5% month-on-month from September (where it sold 41,151 units).

The company attributed this to:

A robust SUV portfolio (especially the Nexon, Punch) that resonated during the festival buying period.

Effective leveraging of the GST-triggered price improvements and festival discount push.

Strong consumer sentiment and high footfalls at dealerships.

This performance signals that Tata is increasingly competing beyond the lower budget segments, and is capitalizing on the shift toward SUVs and higher value vehicles.

3. Other Key Players: Mahindra & Mahindra Ltd & Hyundai Motor India Ltd

Mahindra & Mahindra

Mahindra posted solid numbers in October: domestic PV sales reached 71,624 units, up 31% year-on-year. The company’s total auto sales (including SUVs, LCVs, 3-wheelers) stood at around 1.20 lakh units. The demand for its SUV line-up (Thar, XUV700, Scorpio etc) was a major driver.

Hyundai Motor India

Hyundai recorded total sales of 69,894 units in October 2025, which comprised domestic sales of 53,792 units and exports of 16,102 units. Its strong SUV duo (Creta + Venue) combined for 30,119 units—marking a second-highest monthly tally for that duo.

4. What Powered the Surge? Key Drivers

Several underlying factors combined to produce the sales uptick in this festive window:

• Festival + Buy-Now Mentality

Festive Car Sales October 2025: The Indian automotive market traditionally sees a spike during the period from Navaratri through Dussehra/Diwali/Dhanteras. Buyers tend to time major purchases for the festival season when bonuses, deals and brand promotions align.

• GST 2.0 and Tax Rationalisation

The government’s adjustment of GST slabs on automobiles (‘GST 2.0’) lowered the effective prices for many ICE vehicles in certain segments, which boosted buyer affordability and urgency.

The improved value proposition nudged buyers ahead of possible future price increases or product changes.

• SUV and Value Shift

Consumer preferences continue shifting toward SUVs and premium value vehicles. Tata, Mahindra and Hyundai all cited strong SUV performance. For example, Tata’s SUVs accounted for 70% of its total festive sales.

Maruti too saw utility vehicles yielding strong volumes (77 k+ in Oct).

In short, the market is moving beyond budget hatchbacks into bigger, feature-rich vehicles.

• Inventory and Supply Catch-up

With demand picking up and chip/component shortages easing somewhat, manufacturers were able to fill dealer pipelines and ensure better availability across models.

• Promotional Activity & Model Refreshes

Brands used the festival window to push launches, refreshed models and attractive finance/discount schemes, which spurred footfalls and conversion. For example, Mahindra launched updated Thar, Bolero, Bolero Neo just before the festive period.

5. The Implications

Festive Car Sales October 2025 : Market Share & Competitive Positioning

Maruti’s 220,894 units in month cement its leadership and likely enhance its market-share.

Tata’s leap into the 70k+ monthly domain shows growing brand strength beyond entry level.

Hyundai and Mahindra remain competitive but will need to sustain momentum as the season passes.

Sustainability of Momentum

Festive Car Sales October 2025: While October’s figures are impressive, sustaining that level in the following months (post-festival) will be a challenge. Demand may soften once the buying rush recedes and if inventory builds up. Some analysts caution about component supply risks and economic headwinds ahead.

Product Mix Shift

The prominence of SUVs and utility vehicles signals that manufacturers may increasingly focus on those segments. Budget hatchbacks may see relatively slower growth in comparison. Incentives, launches and marketing will likely tilt toward SUVs, EVs, and premium vehicles.

Export & Global Ambitions

Export numbers were strong for some players (e.g., Maruti’s 31,304 units). The export channel provides an alternate growth engine beyond domestic cycles.

6. Key Take-aways & Outlook

Festive Car Sales October 2025 :

The festive season of October 2025 delivered a powerful boost to auto sales, propelled by timing, tax reform and strong product portfolios.

Maruti set a new high with over 220 k units sold, while Tata made a strong leap to over 74 k units and overtook some rivals in the passenger vehicle retail ranking.

SUVs and utility vehicles clearly dominated buyer interest; tax rationalisation accelerated purchase decisions; promotional activity amplified the effect.

The big question now is: can this surge be maintained? With the post-festival lull, inventory cycles, and macro-economics to consider, manufacturers will be watching closely.

For consumers, this window offered strong value and availability; for dealers, it meant high footfalls and strong turnover; for OEMs, it reaffirmed the importance of agile product strategy and timing promotions.

Festive Car Sales October 2025: In summary, October 2025 will likely be remembered as one of the strongest months in India’s automotive history. While several companies enjoyed elevated performances, Maruti Suzuki clearly led the charge, and Tata’s momentum indicates a shifting competitive landscape. The festive push, tax stimulus and product trends combined to make this a standout moment—and the question now shifts to what the industry does next to sustain and build on this momentum.

Last Updated On 3 November 2025.

See also this: Diwali 2025 Car Sales Boom Indian Automakers Lit Up Market .